*Updated for 2024

I admit the topic of “end of year reports” is not all that exciting, but it’s very necessary… in fact, if you don’t do this right it could have some negative impacts on your business.

No matter if you sell on Amazon as a serious income stream or as an occasional hobby, you’re still required to report your income to the IRS. It’s important to know that there are several reports you should be sure to send to your CPA (or whoever is doing your taxes).

Before we go any further I want you to know that I am not a tax specialist or giving you any tax advice. I highly recommend hiring a local CPA who is knowledgeable of online sales and all the tax implications for your state. Today, I’m only showing you how to get the reports that you need to add to all of your other 2023 tax documents.

If you’re an InventoryLab user, I have very good news for you. The process of getting most of these reports and numbers is incredibly easy. On the other hand, if you’re not an InventoryLab user, while some of the reports in Seller Central are easy to run, there are other reports and numbers you need to calculate that will be very time consuming to do.

Let’s do this!

The most important information you’ll need to have on hand to give your CPA are the following:

- 1099K from Amazon

- Year End Sales Report

- Year End Expense Report

- Year End Cost of Goods Sold

- Year End Inventory Valuation

- Vehicle Expense Report

I’ll break down exactly how to run the right reports and how to access these numbers in the sections that follow.

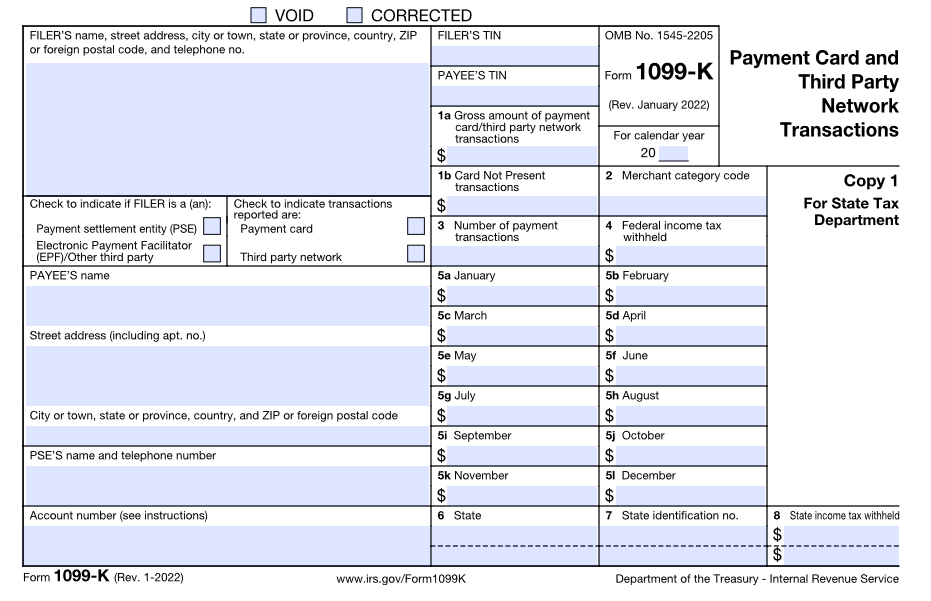

1099K from Amazon

This is an easy report to find and print out. Your 1099K is the report of your gross sales revenue for the year. You’ll be able to download this report directly from Amazon if you’ve grossed over $20,000 in unadjusted sales and 200 or more transactions during the year OR if you’ve had one transaction in 2023 for over $600 (source). Amazon will email you a link on how to access this form sometime in mid-January (usually more toward the end of the month). You can get this report from the Amazon email they send you and from your Amazon Tax Document Library. The report will be ready for download from Amazon sometime after January 1, but before January 31. If you didn’t qualify for this report, then you’ll need to find this information by creating a Year End Sales Report.

This is an easy report to find and print out. Your 1099K is the report of your gross sales revenue for the year. You’ll be able to download this report directly from Amazon if you’ve grossed over $20,000 in unadjusted sales and 200 or more transactions during the year OR if you’ve had one transaction in 2023 for over $600 (source). Amazon will email you a link on how to access this form sometime in mid-January (usually more toward the end of the month). You can get this report from the Amazon email they send you and from your Amazon Tax Document Library. The report will be ready for download from Amazon sometime after January 1, but before January 31. If you didn’t qualify for this report, then you’ll need to find this information by creating a Year End Sales Report.

When you look at your 1099K from Amazon, you might freak out a little because the number Amazon gives you might look like a HUGE number. That’s because the 1099K tells you your gross sales numbers without factoring in things like Amazon fees, returns, and other expenses. The gross sales number is important to know, but it’s not the number you’ll want to report as an accurate reflection of your actual profits. That’s why we’re running these other reports as well.

If you didn’t qualify to get a 1099K from Amazon (grossed under $20,000 in unadjusted sales and under 200 or more transactions), that doesn’t mean you’re exempt from reporting your income. It just means you’ll have to use the Year End Sales Report (see below) in order to get the data you need to properly report your income.

Year End Sales Report

This report gives you a lot of information about your Amazon sales numbers including your FBA sales, non-FBA sales, total Amazon expenses, and total refunds for the year.

If you didn’t meet the $20,000 sales and 200 transactions qualification to get a 1099K, you still need to report your numbers to the IRS. You can do that by running some seller reports in Seller Central. Here’s how:

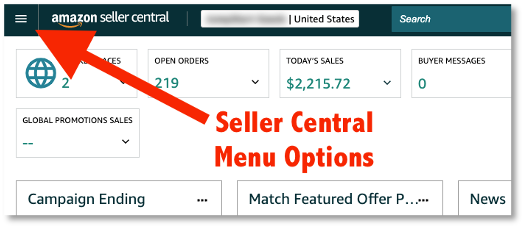

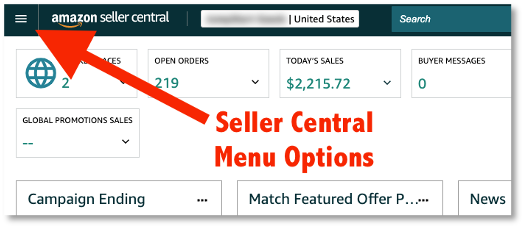

Log in to Seller Central, click the three line icon in the top left corner of the screen, hover over the PAYMENTS header, and click on the REPORTS REPOSITORY option.

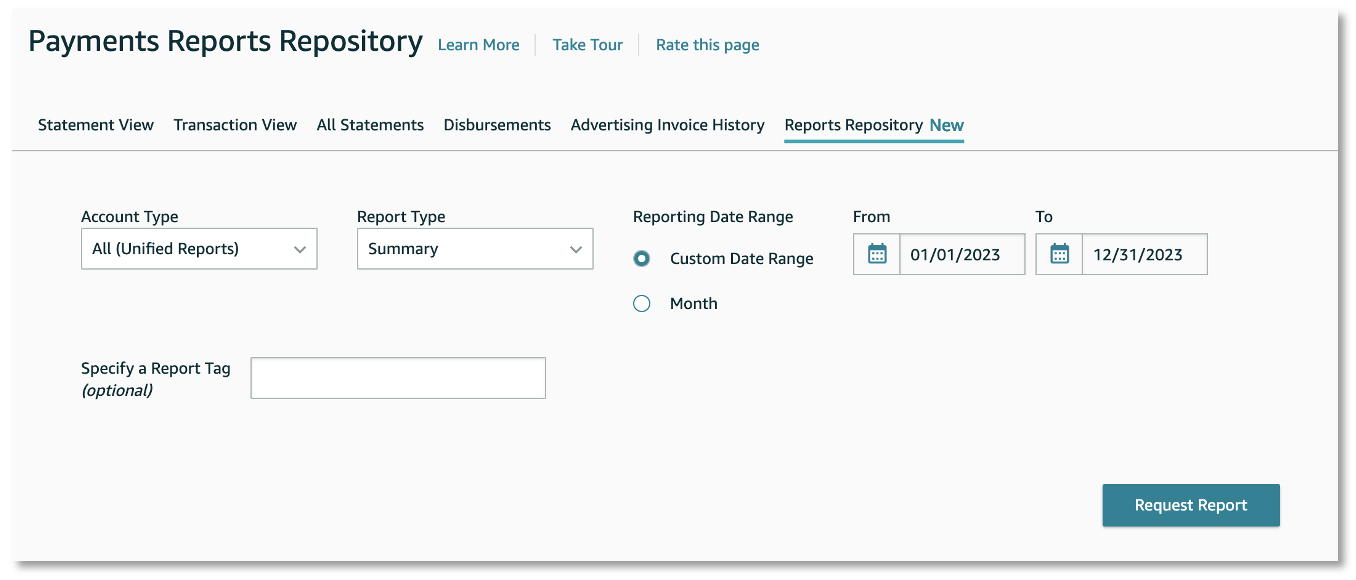

Log in to Seller Central, click the three line icon in the top left corner of the screen, hover over the PAYMENTS header, and click on the REPORTS REPOSITORY option.- Choose or enter the following options to run the correct report:

Account Type: All (Unified Reports)

Report Type: Summary

Reporting Date Range: Custom Date Range

From: Enter from 01/01 of the year to 12/31 of the same year

For 2023, it should look like this:

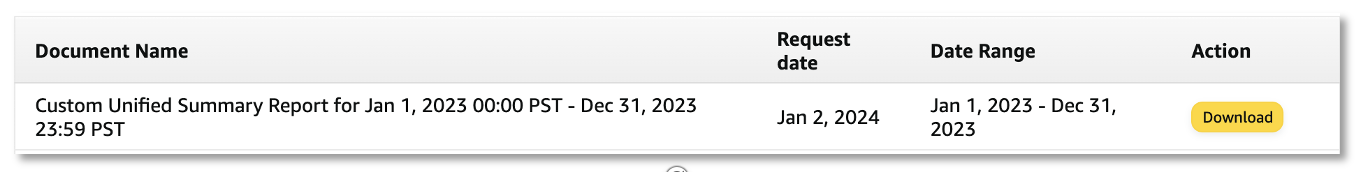

- Click the REQUEST REPORT button.

- It will take a few seconds to generate the report. Near the bottom of the page it will let you know that the report is “in progress” and will give you an option to refresh the page to see if the report is complete. Once the report is ready, the “in progress” status will change to a yellow download button.

- Click on the yellow download button and the report will be saved to your computer.

NOTE: If you do the above steps before December 31, then Amazon will schedule this report to be run first thing January 1. Just remember to come back to this report page to download this report. It will be there waiting for you to download.

If you run this report after January 1, then Amazon will just need a few moments to create this report. You can refresh the link on the report after a few minutes, and you should be able to download it at that moment.

This Year End Sales Report PDF will give you a one-page summary of your income (Amazon sales), expenses (Amazon fees), refunds, sales tax, and bank transfers. This is a PDF that your CPA will want to have in order to best do your taxes.

But, of course, you have had a lot of other expenses (inventory, boxes, office supplies, sourcing apps, program subscriptions, etc.) other than Amazon fees, right? So how can we get those expenses? One way is to create a Year End Expense Report.

Year End Expense Report

Hopefully you’ve been keeping track of all your expenses for the year (as well as all of the receipts, right?). There are many different ways people track their expenses. Some people use a spreadsheet, some use software solutions like InventoryLab, and some even give their CPA or bookkeeper access to their business checking account to track their expenses.

Hopefully you’ve been keeping track of all your expenses for the year (as well as all of the receipts, right?). There are many different ways people track their expenses. Some people use a spreadsheet, some use software solutions like InventoryLab, and some even give their CPA or bookkeeper access to their business checking account to track their expenses.

If you use a spreadsheet, take some time to double check that all your numbers are recorded correctly. Most people have these type of expenses: inventory, office supplies, shipping supplies, physical tools, computer programs, business related subscriptions, training materials (like this course), contract labor, and anything else legitimately connected with a business purpose.

If you use InventoryLab and have tracked all of your expenses there throughout the year, then you can easily run a Year End Expense Report. Here’s how:

- Log in to InventoryLab, hover over the ACCOUNTING tab and click the OTHER EXPENSES report.

- Then click on the ADVANCED SEARCH button.

- Search the EXPENSE DATE from 01/01 to 012/31 of the year you’re wanting to run the report for and click SEARCH.

At the bottom of the screen, you’ll see your total expenses for the time period you entered. You can use this number to give to your CPA. You can also click on the EXPORT button and have a spreadsheet version of the full report.

Year End Cost of Goods Sold

This is the number that totals up the cost of all the items you sold for the year. The easiest way to get this number is to run a quick report within InventoryLab. The report only takes a moment to run and is super easy.

If you are an InventoryLab user, here’s how to get your year-end cost of goods sold:

- Log in to InventoryLab, hover over REPORTS, and click on PROFIT & LOSS.

- Click on the YEARLY report and choose the calendar year you want to run.

- Click the VIEW button.

- Click EXPORT so you’ll have a digital copy of this report.

On the report, you can see the line item of Cost of Goods Sold. Look at the yearly total and you have your Cost of Goods Sold number for the year (provided you entered in your cost of goods when listing your inventory into InventoryLab).

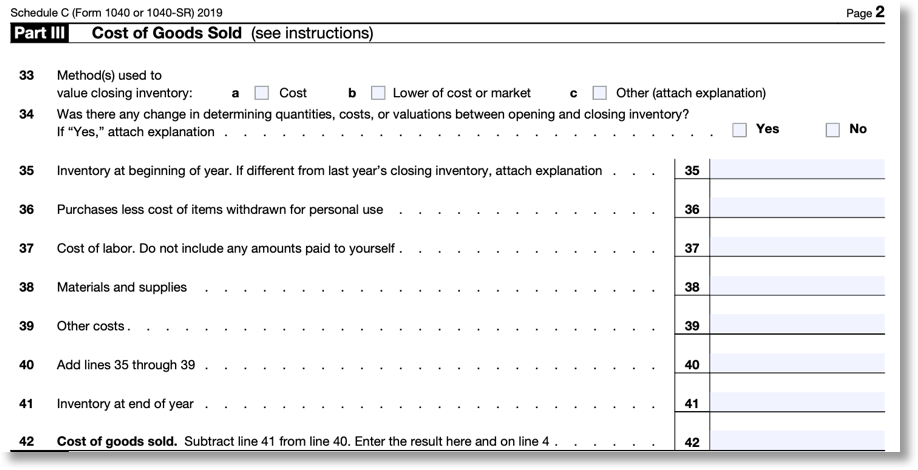

On the other hand, if you’re not an InventoryLab user, this process is somewhat harder to calculate, but not impossible. You can use an IRS form 1040 – Schedule C to help you figure out your year-end Cost of Goods Sold. Below is an example from 2020 on how to calculate this number:

As always, do your due diligence to make sure you’re using the correct year’s paperwork when calculating this number. Most importantly, talk this over with a local CPA to make sure you’re doing this correctly.

Inventory Valuation Report

The Inventory Valuation Report will tell you the current value of your inventory that you currently have in stock at Amazon fulfillment centers (for FBA sellers). Just know that this report needs to be run after January 1 of the new year. If you run it before, it will not work correctly.

If you’re using InventoryLab, this report is super easy to run. Here’s how:

- Log in to InventoryLab, hover over REPORTS, and click on INVENTORY VALUATION.

- Enter the date 12/31 of the year you want to run this report for and click VIEW.

- To get a digital copy, click on the EXPORT button.

Not an InventoryLab user? To calculate your end of year Inventory Valuation you’ll first need to run a FBA Inventory report in Seller Central as soon after the new year as possible. If you do the above steps before December 31, then the report will not be accurate. This will give you a list of inventory items in stock at the end of December (i.e. the end of the year) that you can use to calculate the value of your year-end inventory.

Again, you want to run this report as soon after the new year as possible. I recommend setting a reminder on your phone or computer to remind you to do this on January 1st or as soon as possible after January 1. The closer it is to January 1st, the more accurate the report will be. If you’re just now doing this and it’s February or beyond, still complete this report ASAP as it will be the best you can do at this point.

Here’s how to run this report without InventoryLab:

Log in to Seller Central, click the three line icon in the top left corner of the screen, hover over the REPORTS header, and click on the FULFILLMENT option.

Log in to Seller Central, click the three line icon in the top left corner of the screen, hover over the REPORTS header, and click on the FULFILLMENT option.- In the INVENTORY section on the left, click SHOW MORE.

- Click FBA INVENTORY in the INVENTORY section. Do not confuse this with the AMAZON FULFILLED INVENTORY option.

- Click on the REQUEST .CSV DOWNLOAD button.

- It might take a few minutes, but the report will run and will eventually give you the option to download the report.

Again, if you do the above steps before December 31, then the report will not be accurate.

When you run this report after January 1, then Amazon usually will just need a few moments to create this report. You can refresh the link on the report after a few minutes, and then you should be able to download it at that moment. If you ever get a message that says “No Data Available,” then don’t worry. Amazon may be busy and need a few days to create this report. Come back later and see if the report has been completed.

Now that you have the file, you can open it up in a spreadsheet document (like Excel or Google Sheets). The important info you’re looking for is in the “Available” column. The numbers you see will be the in-stock quantity at Amazon as of when you ran the report (this is why we want to run it as close to after the new year as possible). Within the spreadsheet program, you can sort the “Available” column from bigger numbers to smaller numbers, and then just delete any line that has a quantity number of zero. There is no need to report for the inventory you don’t have in stock for your year end inventory valuation. Now you have a spreadsheet showing you the in-stock stock levels for the end of the year.

Now that you have the file, you can open it up in a spreadsheet document (like Excel or Google Sheets). The important info you’re looking for is in the “Available” column. The numbers you see will be the in-stock quantity at Amazon as of when you ran the report (this is why we want to run it as close to after the new year as possible). Within the spreadsheet program, you can sort the “Available” column from bigger numbers to smaller numbers, and then just delete any line that has a quantity number of zero. There is no need to report for the inventory you don’t have in stock for your year end inventory valuation. Now you have a spreadsheet showing you the in-stock stock levels for the end of the year.

Here is the hard and tedious part of this process. Now you’ll need to go line by line and figure out the buy cost of each of these items you have in stock. You probably will need to reference your receipts to get the correct buy costs for these items. This takes a ton of time (depending on the size of your inventory) but is necessary to report your numbers correctly. Once you are finished, you’ll have your year end FBA inventory valuation.

Of course, that’s just your year-end FBA inventory. Other inventory that you’ll need to add to this valuation includes any items you’re Merchant Fulfilling, inventory you’ve ordered that has not been delivered to your home/prep center yet, inventory that is on its way to Amazon but not checked in, and any inventory you have sitting around your house/office that has not been sent to Amazon yet as of midnight of January 1.

Again, the Inventory Valuation report is super quick and easy to do if you’ve used InventoryLab in the past year, so if you’re looking for a way to make this easier for next year, then I highly recommend signing up for a free trial of InventoryLab. It’s easily in my top 3 tools to use as a successful Amazon FBA seller. Plus starting the year using InventoryLab means zero catch up work to do as the year progresses.

Vehicle Expense Report

All of your business-related miles are tax deductible. These drives could include garage saling, thrifting, retail arbitrage, trips to the store to buy business-related supplies, trips to drop off shipments at UPS, and any other business-related driving. All of these miles are tax deductible.

All of your business-related miles are tax deductible. These drives could include garage saling, thrifting, retail arbitrage, trips to the store to buy business-related supplies, trips to drop off shipments at UPS, and any other business-related driving. All of these miles are tax deductible.

Whether you keep track of your miles in a notebook, in a spreadsheet, or by using the MileIQ app (your miles tracked automatically – highly recommend), be sure to get your mileage for the year to your CPA so they can deduct those miles from your taxes. If you’re not a MileIQ user, here is our review of MileIQ.

![]()

Eventually, you’ll have all of the numbers and reports you need to give to your CPA:

- 1099K from Amazon

- Year End Sales Report

- Year End Expense Report

- Year End Cost of Goods Sold

- Year End Inventory Valuation

- Vehicle Expense Report

Get all of these reports to your CPA ASAP. Tax day for 2024 is April 15, but that day will come very quickly if you don’t gather up all these numbers and reports soon.

You really don’t want to be late on getting the tax process started. Again, if you don’t have a CPA, I highly recommend getting one as soon as possible. It might seem costly, but you want to be sure your numbers are right, and you want a professional to do the work that would eat up way too much of your time if you did it yourself.

Again, I recommend using InventoryLab to keep track of all your business expenses like cost of goods, mileage, supplies, etc. If you don’t have all of your expenses’ data stored in one place, I highly recommend using InventoryLab – especially at the start of a new year so you can have all of your financial data in one place from the start of the year. Get a free month of InventoryLab by clicking here.

Again, I recommend using InventoryLab to keep track of all your business expenses like cost of goods, mileage, supplies, etc. If you don’t have all of your expenses’ data stored in one place, I highly recommend using InventoryLab – especially at the start of a new year so you can have all of your financial data in one place from the start of the year. Get a free month of InventoryLab by clicking here.

*Post updated for 2024

![]()

The Reseller’s Guide to a Year in FBA

The Reseller’s Guide to a Year in FBA

(Updated Each Year)

Make this new year your Best Amazon Sales Year Ever!

Imagine knowing exactly what to expect in your Amazon FBA business every month of the year.

Imagine what it would feel like knowing you were not missing out on any of the opportunities that will come your way in the new year.

Imagine working on your Amazon business knowing exactly what your priorities are, what you need to avoid, and what you need to accomplish during each month to make progress toward making the new year your best sales year ever.

Find out more about The Reseller’s Guide to a Year in FBA: A Month by Month Guide to a Profitable Amazon Business today. The package includes a 275+ page ebook, monthly training videos, and 4 special bonuses.

![]()

If you liked this post and found it helpful, scroll back up to the top and subscribe to the blog. I’ll update you about once a week with helpful tips on how you can make a full-time income with FBA.

Ok, the year is almost over. What other things are you doing during the last week of the year in order to prepare for next year? I’d love to hear what you’re up to this week!

This is awesome information especially for a noob and my first Q4! Thank you!

In order to get the absolutely most accurate data for the Amazon Fulfilled Inventory Report, keep in mind that Amazon closes things out at midnight PACIFIC time. So, if you are in Eastern Time zone, that would be 3:00 AM, Central: 2:00 AM, and 1:00 AM Mountain Time.

Sellers from other countries and time zones should also take this timing into consideration. While many won’t want to actually stay up for the event, it’s nice to know in case you really want to, what time to actually download the report.

Good comment, Georgene! I’m pretty sure the IRS is ok with submitting numbers that are a hair off (and not 100% accurate to the minute), but it’s nice to know that there is a way to get the exact number, in case we wanted to. Thanks for the comment.

Woohooo. 2 am?

I’ll be snoozing at 2am!

Correct!

Thanks Stephen! As always very helpful!

Stephen,

You’ve just made my CPA very happy, me too!!

Thank you so much for this organizational plan.

First year for FBA, this information helps so much.

Thank you for all you do.

All the best for a wonder-filled holiday season!

Yes, just to be clear, I wouldn’t be doing this for anyone but myself. Just because I’m a numbers geek. I KNOW your CPA wouldn’t expect it, hahaha!

Thank you very much!

This will be my first year dealing with Amazon and taxes.

Your information is right on time.

Taking your advice and working with a CPA.

Merry Christmas and Happy Holidays to you and yours….

Thank you! And Merry Christmas to you too!

Stephen, this information was just what I was looking for. You’ve saved me a lot of time and much grief trying to navigate Amazon looking for this information. Your blog is a treasure trove of helpful tips and time-savers. Thank you so much!

This is a fantastic article and will actually help me answer the non-sales tax questions I sometimes see in our Sales Tax for eCommerce Sellers group. Thanks for this resource!

You’re welcome, Jenn. And I love TaxJar! Great site!

Thank you so much. I am new to Amazon, but I know I will need this information eventually.

Thank you. Very timely indeed. I almost forgot I needed to find out what reports I needed to run. I just happened across this on FB. I so appreciate it.

When I try to generate my Monthly Inventory History report, I get “No Data Available”, no matter the dates I select.

Are you choosing the download tab? It should work just fine on the download tab.

I’m also getting No Dara Available.

I have Download Tab,

Exact months

Dec 2019. And. Dec 2019 in the boxes. (That’s what you show)

And Request csv. I’m doing this mid day 12/31/19

I’ve followed your directions for about four years now with no problems….

I wold try again now to see if you get your complete December data now that it’s been a few days.

Hello Stephen

This information is right on time!

Thank you very much.

The free gift on Taxes is appreciated too.

Will have to see if my CPA can help me with that.

Not quite understanding how that works.

Happy New Year to You and Yours….

Your CPA (if they are a good one) will be able walk you through everything you need to know to do your taxes right.

Thank you so much Stephen! I hope you have a very Happy New Year!!!

First the Board Games book and now this help with FBA end of year accounting!

Stephen rocks!

Thanks for another great post. Can you do one that calculates sales tax? I have only run through tax jar’s system and have not looked at it on my own, but for those of us who do… that report is a little daunting to look at. Happy new year!

I rely on Taxjar for all my sales tax information, so that’s the only thing I can recommend to you. But don’t worry, after you take care of it, it gets easier every year. Happy new year to you as well!

Thanks Stephen. I see how to download the FBA inventory, but is there a report that shows my current list of MF inventory?

Stacy, the only way I can think of showing a list of your Merchant Fulfilled inventory is to go to Seller Central, click on Inventory, then Manage Inventory. Click to show active listings (on the left), and then click on “Fulfilled by” on the far right. Then you can see all of the MF together.

I hope this helps!

Thanks for taking the time to blog this Stephen!

I am sure it has been helpful to many Amazon sellers. 🙂

Thank you for the information and, especially, for the reminder Stephen (as I almost forgot!) Have a great New Year!

Thanks for this article! I couldn’t remember which of those reports I needed but I knew it was time! The names all sound the same to me…

I know what you mean… it can get confusing at times. I just hope to bring some clarity to everyone.

Thank you SO much. I just followed step by step to print out all my reports. I just have one question, if you know. I forgot to do this in the morning, and only downloaded this reports close to 11 PM on 1/1. I did make some sales today – if I wanted to go back and reconstruct the report as it should have been this morning, do you know if the inventory report includes items that are in reserve status or not? Thanks so much for your help!!

Martha, don’t worry about needing to get the report “perfect.” The report will not include any items in reserve as you are not officially paid for these items yet. Just use what you have and your CPA will be able to take care of everything for you the right way.

Mom recommended this to me, and I am so glad she reminded me, because I never would have remembered. Thanks for writing this!

Hey guys,

Great information! I’ve been running FBA part time for almost 4 years now and made the leap to full time in the beginning of 2014. I stumbled across your blog today and it’s great to see some like minded individuals having success in the program.

One point to add to this post is that you can get a snapshot of your inventory on 12/31 after the fact. It’s a little different but you can make it work. Go to Reports -> Fulfillment -> Daily Inventory History. From here select download and input the date range of 12/31-12/31 (or 1/1-1/1 I’m not sure which would be more accurate). You can then paste the information from the text file straight into an excel file. I personally like this report better as it shows the title of the items and only those items with units to be counted. You can have excel add up the units from different warehouses for each item to get usable totals by creating a quick pivot table (Click insert -> Pivot table -> Then select product-name OR sku, quantity, and fulfillment-center-id in that specific order in the box to the right).

Phillip

Thanks for the additional info, Phillip!

Ditto what Phillip said, I use the Daily Inventory History report after the fact, with the date range set 12/31 to 12/31. I just ran ours in April.

Thank you so much Stephen and Phillip K! I am new to Amazon FBA (since December) and hadn’t thought about getting this information until today when I found this post. I have my report being generated as I write this. Again thanks for all your help with this very fun and exciting business we all are fortunate to have found!

Hello,

Great article about downloading all these obscure reports! My CPA is not well versed in ecommerce businesses so I would like to know what I should do with these reports (calculate COGs?) to further along the tax necessities. I don’t know which report I need to use to multiply how many units I had in stock for the year 2014 vs. how many units were actually sold (another report)? I would like to crunch some numbers myself as I have not done this before and would love to learn!

Thanks a lot, Stephen!

TJ

TJ, The stats above are all I need to do my taxes. If your CPA is not well versed in e- commerce, it might be time to consider a new CPA. I don’t mean to sound harsh, but you need someone to do things the right way, so that you, your business, and your finances are protected.

Lulu, you can still try and request the info with the dates 1/1-12/31 and see if that works for you. Hope this helps!

Stephen, great post and very helpful to new people like me. Do you know what the IRS is interested most in? For example if I made $100 sales but I spent $50 to purchase those items, are they going to tax me for the $100 or for the $50 profit that I made? Thanks for your help!

I’m not 100% sure, as I’m not a tax professional, and I pay my CPA to take are of all of this for me. I would only be able to guess and I don’t want to give out any advice on a guess.

Stephen – Thanks very much for taking time out over the holidays to share this info! This year is the first year that my biz will need to know these details, the first year I will be using a CPA, and I had no idea where to find all this. It’s super helpful. Have a great New Year!

Great article, very helpful. Do you have any idea what those of us who live outside the US but trade on Amazon.com should do regarding taxes?

I have to say it all seems very complicated to me and I have to admit to being very confused by it all.

Any ideas?

Taxes are usually the most complicated thing to understand. I’m sorry, but I’m not sure what you need to do in order to take care of taxes from outside of the states. Maybe open up a ticket with Amazon and see what they say… or contact an accountant in your area and ask them. I wish you nothing but success.

Thank you so much for such great info!!!

How do you find out the total inventory and sales from the different warehouses you sent your merchandise to? I also included my sales tax in my total cost. Where would I figure out how to get the sales tax amount?

What are your thoughts on Sales Tax Nexus for FBA? I was MF for the majority of this year, but jumped in to FBA in November. Sales tax was easy when I was MF, but not quite sure how to handle it for FBA items, without purchasing something like Tax Jar.

I get all my info about nexus from TaxJar. Apart from them, I don’t know how to answer your question. Hope this helps!

Great article and so helpful. You took the pain out of doing these reports for tax purposes especially on the last day of the year. Maybe this year my accountant will be impressed with me being more organized. Thanks Stephen.

I used these instructions last year and now again this year. Thanks so much, Stephen, for sharing these.

Thank you thank you!!!! So informative and you made it so simple!! I would have been struggling like crazy. I appreciate it so much. Happy New Year!

Stacy

Just the info I needed – thank you! Love step by step instructions, and these were so easy to follow. Question: for cost of goods, do you include the cost of even those items you ended up not sending in? For example items I bought because they looked good when I scanned them at the yard sale / book sale but once I got home and took a closer look on Amazon, I realized that for various reasons it wasn’t, so I put it in my “yard sale” bin instead.

I do include these in my cost of goods that I give to my CPA.

It might be because you had sales, but they have not shipped yet so they are not showing up as completed sales.

Keep in mind folks that the account activity sheet you down load wont include pay per click advertising costs. It has a line item for it but mine was blank. These are fees that are not taken from my Amazon account like other fees, but charges seperately for some reason.

Wow, this information was very helpful, and much needed. Thank you!!

This report does not include RESERVED or IN-TRANSIT inventory, which is very important as RESERVED includes items that are: 1) Quantity reserved for orders, but not paid. This quantity is considered inventory, but does not tally in into the AVAILABLE INVENTORY column. 2) Quantity that is being transferred between FBA warehouses. Depending on the volume that you do, this make a big difference and impact on your real inventory numbers. The only way to do it is to manually go through each time and add the RESERVED quantity to your total inventory number for each item. IN-TRANSIT items are also considered inventory and should be added to your final inventory figure.

Reserved inventory does not count for pending orders because they can always be cancelled due to various reasons. What counts are items shipped which is after payment is processed and credited to your balance.

I think the Manage FBA inventory report has everything. let me know if im wrong.

Thanks Stephen for the detailed step-by-step instructions on running our end-of-year reports. Very timely for me as I am looking to improve my inventory and sales reporting to my CPA this year. Also thanks for the reminder to make sure to run the reports on 12/31 or early 1/1, I didn’t do that last year and had a hard time getting my inventory numbers for my CPA. You never fail to provide us with good, accurate, timely and extremely helpful information always.

Thank you! This was a huge help. You have great content!!

Stephen or anyone else,

What do you guys do with inventory that you purchased and shipped in, but has yet to hit the FC? Or inventory that is still at your house that you have not sent in yet? Shouldn’t that be included in your ending inventory number?

I’m wondering the same thing, actually. I’m assuming you submit a “sitting-at-home” inventory list. Any tips/tricks?

Happy New Year by the way!

I am not an accountant but as long as that inventory belongs to you, it must be reported. This guide was intended to show sellers the necessary steps to pull reports for inventory located at FBA specifically.

Thank you so much!

Thank you Stephen!!! I needed that info!

Awesome info, thanks so much! When I went to get the year end inventory report, it had several reports for each day of the year. I just used the Dec. 31 one instead of requesting one on Jan. 1. I guess Amazon just does this for us?

Are you talking about monthly inventory report or received inventory report? Be noted that monthly report at the moment does not have data for December since there is some delay in reporting.

thanks again for this helpful article- you help so many! Thanks for taking the time.

Is there a way to find out your sales by State?

Laura,

Hope you were able to solve this already, but if you weren’t, I was able to run the “Amazon Fulfilled Shipments” report under the “Sales” category. In that report, it gives you the recipient along with the “ship-state.” You can open the file in Excel and create a Pivot Table to sum each state.

So thankful for your sharing with us.

This was a really helpful article thanks!

I’m looking at the pdf of the sales/fees/income report and not totally understanding how to look at it. Can I look at this and see how profitable I was for the year? Obviously I know COGS affects my profitability but just within this report what exactly is it telling me? Thank you!

is there any way to run this report after 12/31?

Thank you! Thank you! Thank you! soooo much for this valuable and timely post Stephen.

Thank you! You’re always SO helpful! I’ve been doing MF for several years and always kept my inventory reports on what I had in stock. This is my first year FBA… but I am curious about something… last year was the first time I used a CPA…. and she threw out my inventory report and said that I didn’t need to report my inventory since I use the Cash basis accounting….. does that sound right to you? It worries me a bit… and more so now with these reports…. Open to your thoughts. Thanks!

Hi Margie,

I’m not an accountant. But I do think you need to know what your inventory is so that you can determine a value. I file using the cash basis also. With that method you can only deduct the cost of inventory as an expense if it sold.

Therefore, you need to know what your beginning and ending inventory value is because the difference is what you get to use as a deduction on your taxes.

If I’m all wet with my understanding, I’d like someone more knowledgeable to set me straight!

Thank you Ree! That’s always how I’ve always done it too…. I wasn’t very happy with the CPA I used last year, and I was shocked when she threw out my inventory. I appreciate the back up and I think I’ll be looking for a new CPA this year. 🙂

Thank you once again for providing great information! It really helps us run our part time AMZ business.

Happy New Year!

Dale’s Bookcase

I have an annual Google calendar reminder with Stephen’s link to this post. Thanks for updating it as well. It’s critical information, good luck getting it anywhere else. Can’t thank you enough. Will say I’m really disappointed that Amazon no longers allows a full year PDF download of the Summary Report. Mentioned above, you need to do it in portions. 3 months increments are stated above, but the Amazon report page does allow 180 day increments. I did 4 month increments which reduced the reports to 3 total.

Thank you for the step by step way to get different reports. It is very helpful to a beginner like me. Kuddos!

Thanks! You are a life saver each year.

This has been a blessing for you to publish this. Thank you soooooo much!

Hi Stephen! So…what if you’ve made a noob mistake and you’re just now printing your year end inventory in February? What kinds of adjustments do I need to make from this report pulled in Feb – is it as simple as “subtract anything you’ve sold after Dec 31?” Help! 🙂 ((I’m too small of a fish at the start here to go full CPA/Tax Jar/Inventory Lab (will ramp up next year), so the good news it will only be a short list of sales for Jan/Feb to subtract.)) But when taxes want to know “Beginning Inventory” = zero, and “Ending Inventory”, will this report be enough to extract that? Thanks!

Another year and another thank you!

Another “you’re welcome!” 🙂

For Sales for the year, noticed that Amazon only allows download for the last 30 days. Anyone know where/what to download to get sales for the whole year in order to track by state?

You can change the time period for the report.

When I run this report it doesn’t show the “product title,” but rather the ASIN. This would take a long time to then figure out the total cost value of my inventory left over as I’d have to type in each ASIN in Amazon to figure out which product it was. I then tried the monthly report like you mentioned, it does show product title but it mentions the items in almost every month which is not what I’m looking for. Is there a way I can get the final report but with product titles?

Hello Guys.

I want to take a look of my last month’s report but I’m not sure if the report has the inbound items that I ship during the month..

How can I find the complete report with inbound also.

Hi everyone… I thought I’d share something I discovered today. It’s a new report called RESTOCK INVENTORY and you will find it under Reports/Fulfillment.

This report lists all of your SKUs (including the title) for which you currently have the listing set to FBA. It shows the total inventory count and also has columns that break it down to Available, Inbound, FC transfer, FC processing, Reserved for a Customer Order and Unfulfillable.

I scrubbed this report to ensure it matched what I know to be accurate and it is a fantastic report that provides all the detail I need to value my inventory at year end!

It’s a real-time report so pull it late on December 31st or first thing January 1st.

The only thing I will do to this report is to subtract any open POs that I haven’t yet paid for. That’s because the Inbound unit count includes all inbound shipments regardless of status.

I hope this makes everyone as happy as me!

Cheers,

Ree

Thank you REE!!!! Have a wonderful new year!

Thank you so much… I needed this!!!

Doesn’t Inventory Lab have a report that will give the value of your year end inventory?

Yes, I show you the step by step process on how to run this report in InventoryLab in this blog post. .

This was a helpful article except for one problem: When I ran the “Year End Sales Report”, the “Cost of Advertising” line under “Expenses” was blank.

.

To obtain my advertising expenses, I went to: Reports->Payments-> Tab saying “Advertising Invoice History.”

The monthly report under fullfillment does not work. It says no data.

I am not sure why it is not corrected yet.

Stephen, is there way to access a report already generated and downloaded many months after the fact? For example, I run the Manage FBA Inventory report on the first day of every month. My CPA is asking to verify the file I provided him for my year end inventory as of 12/31/2019 by getting access to seller central and comparing the file that I downloaded at the time to the file I emailed him, but I don’t see a way to access my download history that far back.

Thanks!

Thank you for this, it is really informative especially for those who are just starting their journey on Amazon FBA, as for those who are already experts in the field it is still a great reminder and update also.

Monthly Inventory History

Choose From: (12) DECEMBER 2020 to: (12) DECEMBER 2020.

should be

Choose From: exact months From: January 2020 To: December 2020

Correct

never mind, i get it now it should be dec to dec of the same year

I never never write comments but my anxiety was soooo high on surfing the internet to try and find the reports necessary for my income taxes. I couldn’t get it answered in any of the normal places. I believe your so well written instructions saved me about a week of stress and anxiety. The instructions were EXACT. I have googled other things before and the instructions never match up leaving you more frustrated. DEEPEST GRATITUDE-THANK YOU!!!

You’re so very welcome!

Is there a way to run a report in Amazon for the year-end inventory levels that is NOT FBA?

This is great information. When I run the follow the directions in the section of this blog post titles “Inventory Valuation Report,” I get the Amazon Report that lists all remaining inventory at the end of the month. However, it breaks down my ASINS based on which Fulfillemnt center they are in. Is there an easy way on a spreadsheet to combine these numbers for each Fulfilment Center for each ASIN to get a TOTAL number of each ASIN? Thank You!

Could you use inventory labs in place of quickbooks… I have IL and didn’t even realize it had all these features.

I don’t use Quickbooks, but InventoryLab and a CPA… so, yes! You can do this without quickbooks.

Hi Stephen!

Do you know what is the best way to submit my CDTFA to my CPA or how can we set up to do it ourselves on the CDTFA website? Would my CPA have the login info or do I create one myself. They have been doing it for us.

I guess I don’t totally follow the reason for the inventory report and getting the COG for each of those items. We don’t pay taxes on the items until they sell so I’m not seeing what value there is in building a report that shows the inventory on-hand with the COG fir each item.

Feel like I’m overlooking something obvious….

Talk to your CPA and that will explain why you need all this information to correctly do your year end taxes.

I use Quickbooks self-employed. It includes a mileage tracker for only $4.99/mo. Big plus, all the data will migrate over into TurboTax automatically for you. Just review all your reports, make any changes or corrections and send. It’s great.

Thank you for the great info. What would you consider the “industry” norm for an acceptable FBA inventory variance % at the end of the year when comparing our system to what Amazon says (taking into account what’s at FBA, what’s still inbound, etc.).

It is Feb 2023 and when I log into look fro the inventory report, I dont see “monthly inventory history” as an option anymore. Has amazon changed it? I need to run a year end inventory report for end of 2022 for taxes

Unfortunately, Amazon discontinued this report sometime in February of 2023. I’ll see if I can find another way to do this manually.

Any update on this?

I think this can be done with the new Inventory ledger report: Seller Central > Reports > Fulfillment > Inventory > Inventory Ledger.

I used:

– Type of report: Summary view

– Aggregate report by location: Country (as I only sell in the US)

– Date range: specific months (december of the fiscal year)

Hope this helps. Trying to pay it forward for this great article.

I’m a little confused, if we get a 1099k do we also need the year end sales report or does the 1099k cover that information?

It’s good to have both… give both to your CPA and they will know what to do with them both so your numbers are accurate when you report them to the IRS.

This is no longer accurate. Amazon does not provide a MONTHLY INVENTORY HISTORY report any longer to view unsold inventory, and have to use the new Inventory Ledger report, but what about FBM inventory?

They used to include that in reports to download as well.

Sure wish they would leave what works alone.

Thanks for the comment… we’ll see about updating this when we figure out the workaround.

Thank-you very much for these incredibly easy-to-follow instructions. They made my day!

So the the Amazon Year End Sales Report is only necessary if you don’t have the Amazon 1099?

I use them both…. talk to your CPA to get the best advise for your situation and business.

Will the annual summary report be enough for filing taxes? Is it okay to use the summary report instead of using the annual transaction report? Just want your expertise on this before i file my taxes tomorrow. Please help. Thank you.

My advise is to speak to a local CPA to help give you the best advice. Even if you just need to pay for a half hour of their time. When it comes to taxes, you don’t want to listen to me, you want to listen to a local CPA who understands your home’s laws to follow. That’s my best way to help you today.

As a longtime Amazon seller I have never used Inventory Lab given all the complaints I’ve heard about it over the years from sellers, and also I typically have less than 500 items for sale. I also sell a lot on other selling websites. I keep track of my inventory via custom SKUs, and as I venture further away from Amazon to selling on other channels such as Walmart, etc, wanting to see your thoughts on any inventory/AI tools available that is geared towards tracking of inventory on multiple channels.

What are the complaints you’ve heard about Inventory Lab (other than being an Amazon only specific platform)?