Before you hit the snooze button and move on to a more exciting post, let me acknowledge up front that taxes aren’t the most glamorous topic out there. Unless you’re a CPA or tax professional. In which case I don’t mean any offense by saying that taxes are boring.

Is anyone still with me at this point in this blog post? I hope so – because the topic of taxes, while potentially a snoozer, is of great importance to the success of your Amazon FBA business. If handled incorrectly, your business taxes could negatively impact your success at FBA – but taxes don’t have to be something that holds you back from making progress as an Amazon seller.

We at Full-Time FBA are not tax professionals or CPAs, and we do not intend to give advice for preparing your taxes in this blog post. We also do not give advice in our Facebook group, so if you ask tax questions there we will give you the same disclaimer and point you towards the services of someone qualified to give that type of advice.

Which leads us nicely to our first tip out of four for handling taxes for your Amazon FBA business…

1. Find a good CPA.

1. Find a good CPA.

Our biggest piece of advice for you when it comes to handling your taxes is to find a good CPA who can take care of all the nitty gritty details for you. We are greatly indebted to our own CPA for her help throughout the year and at tax time in keeping our business running smoothly and above board with our taxes. A good CPA will know all the ins and outs of the rules related to business taxes (both federal and state, depending on where you live), and a good CPA is worth every penny you pay for their services.

When I say you need to find a “good CPA” I mean a couple of things by it. First, you don’t want to just pick the first person who pops up in a Google search for CPAs in your area. You need to find someone who has the heart of a teacher, who is willing to help you understand the tax rules and how to be compliant. It might take time to find this person and to ask questions to make sure you’re a good fit with each other.

Note: Please do not go to a bunch of different CPAs and ask questions under the pretense of “seeing if you’re a good fit.” For a service professional, nothing is worse than being taken advantage of by someone looking for free advice. Be respectful of your potential CPA’s time and pay them well.

The second thing you need to look for in a CPA is someone who understands taxes as related to ecommerce, Amazon FBA, self-employment, an LLC, or whatever particular situation your business is in. Be sure to ask questions up front to make sure the person you hire has the relevant experience to best assist you in preparing your taxes.

2. Keep good records throughout the year.

2. Keep good records throughout the year.

Keeping good records is crucial to preparing your taxes and protecting yourself in case of audit. Your records should include (but aren’t limited to) receipts for inventory, receipts for supplies, receipts for any other business expenses, records of your disbursements or other income, any business-related fees, any payments for business-related services, etc.

We use Inventory Lab to track inventory-related financial information, and we have our CPA do our bookkeeping every month throughout the year. We have a simple system for filing our receipts by month, and we use Evernote and email folders to track online receipts.

Whether you already have a good system in place for keeping good records or not, nothing is stopping you from keeping your records organized from this point forward. You can’t change the past, but you can make a difference in the future. Don’t get overwhelmed with your receipts, take it one step at a time, and make the most of the year ahead by knowing your numbers, organizing your receipts, and paying attention to business reports in Seller Central, Inventory Lab, or whatever program you are using.

3. Run the right reports for your CPA.

3. Run the right reports for your CPA.

In order to prepare your taxes, your CPA (or whoever is preparing your taxes) will need to know the money you have coming in, the money you have going out, the amount of inventory you have in stock that hasn’t been sold, etc. Talk with this individual to be sure exactly what they need.

As a good starting point you can check out this blog post with instructions for how to run the most useful year end reports within Seller Central. We like to run reports for our CPA on our year end inventory, our monthly inventory history, and our received inventory.

Note: It’s best to run your year end inventory report as close to December 31 or January 1 as possible, to give your CPA the most accurate picture of the inventory you had in FBA warehouses at year’s end.

4. When it comes to sales tax, look into services like TaxJar to automate the process for you.

4. When it comes to sales tax, look into services like TaxJar to automate the process for you.

We like to point our readers to the TaxJar website when it comes to handling sales tax. TaxJar has a wealth of free information and links on their website to point you in the right direction for knowing the sales tax regulations in each state. When you’re ready to automate the process of dealing with sales tax, TaxJar can help you get set up.

Dealing with taxes definitely isn’t the most fun part of running your own business – we would all rather be out sourcing and finding treasure and making big profits than talking about taxes, right? But getting your business set up to handle taxes correctly is an important component of business success. You really want to do things the right way as quickly as you can, so that you won’t have to pay penalties or fines later. You can take a few simple steps today to set yourself up for the year ahead and make the most of your Amazon FBA opportunities.

![]()

Make this year your Best Amazon Sales Year Ever!

Make this year your Best Amazon Sales Year Ever!

Imagine knowing exactly what to expect in your Amazon FBA business every month of the year.

Imagine what it would feel like knowing you were not missing out on any of the opportunities that will come your way this year.

Imagine working on your Amazon business knowing exactly what your priorities are, what you need to avoid, and what you need to accomplish during each month to make progress toward making this year your best sales year ever.

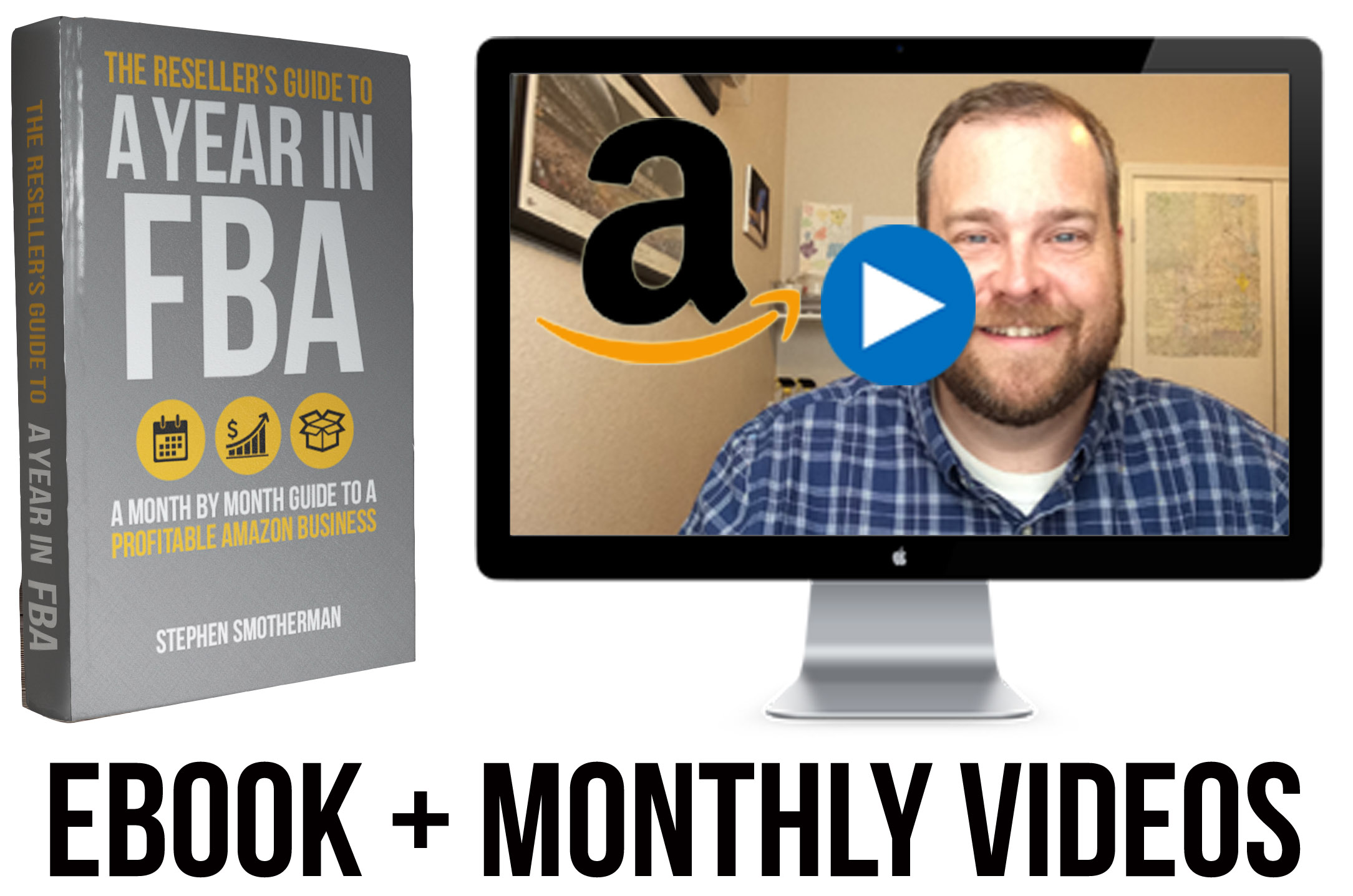

Find out more about The Reseller’s Guide to a Year in FBA: A Month by Month Guide to a Profitable Amazon Business today. The package includes a 275-page ebook, monthly training videos, and 5 special bonuses.

![]()

What are you doing today to prepare for the year ahead? How are you taking steps to handle your taxes the right way? We would love to hear from you in the comments!

Hey Stephen,

Thanks for publishing the end-of-year reports again. I know I can count on you to remind which ones I need every year. I’ve already run those for 2016.

Quick question please, in the post above, you mentioned simple ways that you guys keep up with receipts/taxes/etc using Evernote and other software and folders. Would you mind elaborating on those please? It’s always interesting to hear about processes that others use.

Thanks and have a Happy New Year!

You can use the Scannable app and take pics of your receipts and have digital copies sent you Evernote. Also, you can use the Neat Receipts Scanner too. Check it out here: http://amzn.to/2ji6v2z

Hi

I am from the Uk and I see that this book is mainly for US .

can the content be used for FBA in the Uk

Thanks for the solid advice Stephen.