In our last blog post, I wrote about why budgets are so important to the success of both your business and personal finances. If you haven’t read that blog post yet, be sure you check it out here.

In today’s blog post, I want to move from the “why” to the “how” and show you exactly how my wife and I handle both our personal and business finances. I hope this will give you an idea about how you (and potentially your spouse, if that applies to you) can come up with a budget that will help you eliminate wasteful spending and increase business profits and personal savings.

How My Wife And I Budget

I’d like to show you a glimpse of what our own budgeting looks like each month, just to give you an idea of how the process works for us. What works well for us might not be exactly what works for you, but seeing an example will at least give you a starting point and some ideas for what you can try in your own household or business if you need help developing a structure for monthly budgeting.

Budgeting doesn’t have to be complicated or scary. A budget is basically figuring out ahead of time where your money is going each month, instead of wondering at the end of the month where it all went. If you spend all your money on paper first, you will be much more likely to make good choices throughout the month and not end up with a week left to go in April and no idea how to make it to May’s paycheck, not to mention you’ll be able to set and meet short-term and long-term goals with greater ease.

Budgeting doesn’t have to be complicated or scary. A budget is basically figuring out ahead of time where your money is going each month, instead of wondering at the end of the month where it all went. If you spend all your money on paper first, you will be much more likely to make good choices throughout the month and not end up with a week left to go in April and no idea how to make it to May’s paycheck, not to mention you’ll be able to set and meet short-term and long-term goals with greater ease.

For us, spending our money on paper means both myself and Rebecca sitting down together towards the end of each month and having a business meeting. Don’t be alarmed by the title “business meeting.” We don’t follow Robert’s Rules of Order or anything like that. We just sit down with our account information, a few lists of numbers, a calculator, and a calendar, and we talk things through for the upcoming month. Simple as that.

When we first started budgeting together, these meetings took longer than they do now. The first business meeting, in particular, lasted quite a bit longer as we were setting up the foundation for what our monthly and yearly expenses would look like. After many years at this now, we are down to only a few minutes for the monthly meeting because we’ve both done the prep work ahead of time, and there’s just not as much to discuss as there once was.

When we first started budgeting together, these meetings took longer than they do now. The first business meeting, in particular, lasted quite a bit longer as we were setting up the foundation for what our monthly and yearly expenses would look like. After many years at this now, we are down to only a few minutes for the monthly meeting because we’ve both done the prep work ahead of time, and there’s just not as much to discuss as there once was.

So, what exactly do we include in our monthly budget? I’ll outline a few steps that we’ve taken in the initial phase of setting it up and in the ongoing process of budgeting each month. The example given below describes how we allocate money for both our personal and our business expenses, which we differentiate into two separate checking accounts. If you’re reselling as a hobby and don’t keep separate business and personal accounts, this plan still works – you just won’t need to do the division in step 8 below.

1. We list our regular monthly household expenses.

1. We list our regular monthly household expenses.

We wrote out on a notepad everything we spend on a monthly basis, including housing, utilities, phones, gas, groceries, insurance, restaurants, haircuts, and what not. Some of these may fluctuate throughout the year (e.g., electricity is higher during the very hot or very cold months, and we don’t always get haircuts every single month), so we came up with an average or looked at how much we spent during particular months of the year based on previous years.

For some budget categories, like groceries or eating out, it was hard to know at first how much we spend on a monthly basis because we weren’t really tracking each individual household expense, so it took some educated guessing. It’s not imperative to come up with exact amounts on the first month of your budget, but at least get some ballpark-range numbers down on paper so you have a place to start. If you have credit card, loan, or car payments, you’ll also want to list these here, as well as any regular payments you make towards savings goals.

2. We listed our annual fees and the month they are due.

2. We listed our annual fees and the month they are due.

In this list we included annual insurance premiums, subscriptions (magazines, Amazon Prime, web hosting, etc), vehicle registrations and inspections, gym memberships, wholesale club fees, and things of this nature.

3. We listed all the occasions when we regularly give gifts throughout the year.

We included birthdays, anniversaries, holidays, and any time when we know that we need extra money for gifts each year.

4. We set up a binder so that we’ll have easy access to these lists and any printed out reports we need to save.

4. We set up a binder so that we’ll have easy access to these lists and any printed out reports we need to save.

Can you tell we like to watch Parks and Recreation? We, like Leslie Knope, enjoy organizing info in binders. You don’t have to get a binder. You can also just keep all your papers in a desk drawer or on the floor in the corner of your office. It’s up to you.

5. After we knew our monthly and annual expenses, we wrote out a tentative budget.

We wrote up how much we planned to spend in a month on each of the categories we had listed in our expenses. Where possible, we wrote out the exact amount we knew would be on a bill. In other cases, we set an estimated number based on what we’d been spending in previous months. The key is to choose amounts that you’re comfortable with, but give yourself flexibility in the first months of following the budget — we all tend to underestimate how much we spend on groceries, and you may find that you’ve set your amount too low. That’s perfectly fine — just adjust the amount each month until you find a number you’re comfortable with.

We wrote up how much we planned to spend in a month on each of the categories we had listed in our expenses. Where possible, we wrote out the exact amount we knew would be on a bill. In other cases, we set an estimated number based on what we’d been spending in previous months. The key is to choose amounts that you’re comfortable with, but give yourself flexibility in the first months of following the budget — we all tend to underestimate how much we spend on groceries, and you may find that you’ve set your amount too low. That’s perfectly fine — just adjust the amount each month until you find a number you’re comfortable with.

6. We add our regular expenses to our special expenses for the month to come up with our total projected monthly expenses.

At the monthly budget meeting, we look at our regular expenses for the month (both the monthly expenses and any annual expenses that are due), along with anything special going on that month that will require extra funds. Special expenses might include birthday parties, an oil change for the car, a new outfit for an upcoming event, a graduation gift, a donation for a special cause, savings for a trip a couple of months away, or Christmas savings. We take the dollar amount needed for regular expenses, add it to the dollar amount needed for special expenses, and get our total projected expenses. It’s as simple as that: now we have our budget for the month.

The next steps will allow us to figure up how much money we have to source with after we’ve paid our bills.

7. We add up our projected income.

7. We add up our projected income.

If you get regular paychecks, this is a pretty easy step. For Rebecca and I, the bulk of our income is determined by our sales every two weeks on Amazon, which we can’t know ahead of time, and we may or may not know in advance how much income we’ll be getting from freelance projects or royalties – but we try to make our best estimate. Whatever situation you may be in with regular or irregular income, do the best you can to get an estimate of your projected income.

8. We allocate our business and household expenses into our paychecks and disbursements as we receive them.

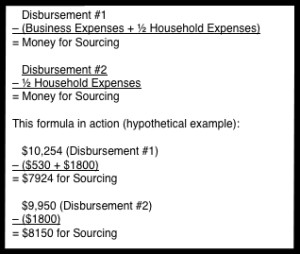

This part will be different for everyone, depending on whether you have income that comes in once a month, bi-weekly, or at irregular times. In our case, we get two bi-weekly disbursements per month from Amazon for our FBA sales, and these amounts cover all of our regular household bills (we use our freelance income and other sales money for other purposes throughout each month, and we consider it separately when it comes to the household budget). So, we take the dollar amount of our expected expenses, and we divide it by two, for the two disbursements. Click on the image above to see an idea of how this works out. (NOTE: The numbers in the image are completely made up. These are not our actual business or household numbers. The example is for math purposes only.)

This part will be different for everyone, depending on whether you have income that comes in once a month, bi-weekly, or at irregular times. In our case, we get two bi-weekly disbursements per month from Amazon for our FBA sales, and these amounts cover all of our regular household bills (we use our freelance income and other sales money for other purposes throughout each month, and we consider it separately when it comes to the household budget). So, we take the dollar amount of our expected expenses, and we divide it by two, for the two disbursements. Click on the image above to see an idea of how this works out. (NOTE: The numbers in the image are completely made up. These are not our actual business or household numbers. The example is for math purposes only.)

Then, when I get the amount for the first bi-weekly disbursement for the month, I take that amount and subtract both the upcoming business expenses for the month and the upcoming household expenses for the month. The number I’m left with is how much money we have to source with for the next two weeks. When the second disbursement comes around, I subtract out the second half of our monthly household expenses, and we’re left with what we can use for sourcing for the next two weeks.

Sometimes we’re flexible with the divisions, putting more or less towards personal or business during each two week period, depending on the circumstances that month. But we always make sure we cover family expenses out of our FBA disbursements and supplementary income first, and then we use the remaining money for sourcing. Our business has grown and grown over the past several years in such a way that this system works really well for us. If we didn’t have a family budget, though, it would be easy to fritter away the money from the business on expenses around the house that just aren’t necessary, and then we wouldn’t have the money for sourcing that we need to keep the business running.

Sometimes we’re flexible with the divisions, putting more or less towards personal or business during each two week period, depending on the circumstances that month. But we always make sure we cover family expenses out of our FBA disbursements and supplementary income first, and then we use the remaining money for sourcing. Our business has grown and grown over the past several years in such a way that this system works really well for us. If we didn’t have a family budget, though, it would be easy to fritter away the money from the business on expenses around the house that just aren’t necessary, and then we wouldn’t have the money for sourcing that we need to keep the business running.

When coming up with your business expenses, it’s important to follow the same steps as above. List your regular monthly business expenses (Amazon fees, listing subscription fees, shipping supplies, office supplies, etc). List your annual expenses (your yearly membership to a sourcing website, etc). Come up with a tentative budget and do your best to stick to it. Creating a business budget is not much different than creating a personal one.

Recommended Book Reading – Profit First

Recommended Book Reading – Profit First

If you’re serious about running a business and want an even more detailed outline of how to successfully handle your finances with your personal and business accounts, then I highly recommend Profit First: Transform Your Business from a Cash-Eating Monster to a Money-Making Machine by Mike Michalowicz. For over a year now, this book has been ranked between 1000 and 2000 on Amazon (as of Sept 2020) and can help you better understand how to run a business that actually makes money instead of loses money. The best part of this book is that it’s not some boring accounting book, but rather an entertaining and humorous (and super effective) way of looking at your finances, budget, and profits!

The key is just sticking to it.

I’m not saying you need to do everything exactly the way we’ve done it and outlined above. I’m just saying you should make a plan, talk with your spouse, follow through with it, and see where it takes your family and your business.

Do you have any budgeting tips to help minimize losses and maximize profits? Be sure to comment below.

*Post updated for 2020

Check out ynab.com, I think you’ll really like it. Stands for You Need A Budget. We have been using it for a few years know and are very happy with what we have accomplished. Teaces you to live on last months income among other sound principals.

Yes, there are some great budgeting tools out there. YNAB is great. Also “Every Dollar” by Dave Ramsey is a really good one! A simple spreadsheet might be a good place to start and to gain an idea of what you want to do with your personal and business budget, but once you have that completed, budgeting tools like YNAB or Every Dollar are really good to look into.

Great advice. I like the binder idea but most of my record keeping is done through QuickBooks and Excel just because I’m more of a visual person and being able to instantly graph charts out helps me a lot.

I just started doing the FBA program at the beginning of 2015 so for records purposes works out great. To budget for my profits and losses I created a spreadsheet in excel where I can easily input numbers into cells and then calculate net gains, ROI, losses, and other various expenditures.

Right now I use a fixed amount of $200 for sourcing every two weeks and stick with that number. Once I hit my sourcing limit the shopping stops until the next payout comes in and then I just roll that over into the next sourcing trip.

I still have a long way to go and a lot to learn but this is the first online business venture where I’m actually having a lot of fun learning all the ropes.

We use Excel too, in fact, our Excel documents are put in our binder when we are done looking at them for the month.

Sounds like you have a good plan in place to record and keep in control of your finances! You’re off to a good start!

If we buy products that have wiggle room in the pricing, we feel confident that we can sell every product we send in to Amazon FBA for a profit.

I feel the same way, CharlesLora!

Thank you for this budgeting series. A lot of FBA teachers don’t cover this topic. Have you ever/would you consider taking weekly distributions (instead of bi-weekly) in order to cover the cost of staying in-stock on items instead of the lag time that comes with the bi-weekly distributions? Thank you!

I like having to wait for one lump sum bi-weekly as it helps us make better budgeting decisions. Having business money in the pocket can quickly burn a hole and be gone too fast!

Ain’t that the truth! Thank you for the answer.